Meet the Client

Frontier Payments, Madison Avenue, NYC start-up, was looking to capitalize on the lack of credit card acceptance in cabs across the U.S. Majority of cabbies are independent businesspeople and cannot afford the cost of installing and operating a credit-card machine in their cabs. Many cabbies don’t even have checking accounts.

A fresh graduate from the Wharton School of Business, Jason Diaz, Frontier’s founder and CEO, accepted a position in a NYC consulting firm conducting business with the city of New York offering advice to the NY City Cab Commissioner. Later, Diaz was offered and declined the commissioner’s job to instead start Frontier Payments. “I have a hack license, and I know cabbies—what their struggles are and what type of model will work,” said Diaz.

The Challenge

Frontier Payments had a problem: How to design, deploy, and manage a network that would rapidly grow taking two separate paths: kiosk and attended–without a model to compare it with.

Frontier employed NYC technology-consulting firm, Cole Systems to search for a company who could deliver on such a unique requirement. They found Livewire. Keil Merrick, Project Manager for Cole Systems, knew of Livewire’s success in ski lift ticketing and quickly realized the synergies.

“It was difficult finding someone who had the expertise and the volume experience we were looking for. When we found Livewire, we quickly realized we had a match. Few companies could match the technical expertise as well as the proven business model we were searching for.”

“After looking at what Frontier wanted to achieve, we quickly realized the similarities between their model and our Transaction Engine application,” said David McCracken, CTO for Livewire Kiosk.

Self-Service Transaction Processing

Accountability

Network Integration

The Solution

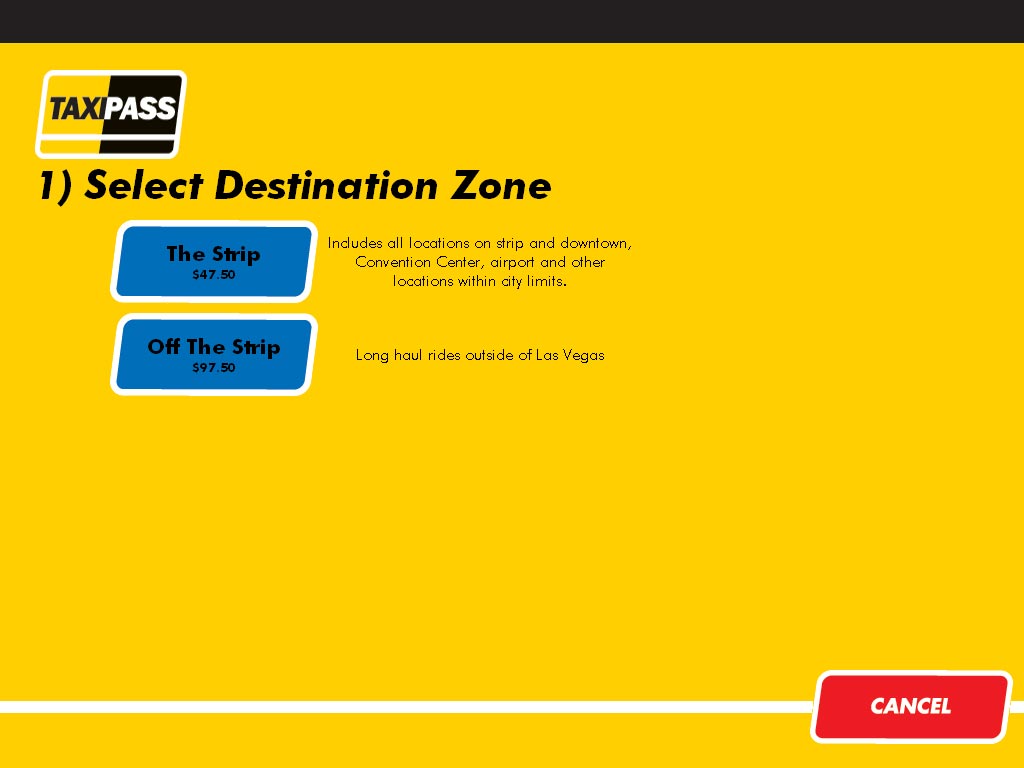

Using the Transaction Engine software as a basis, and the experience from operating a transaction network that sells millions of dollars worth of tickets each year, the Frontier TaxiPass application was developed. The unique part of the project was the development of the handheld application. Similar to what you would see at a rental car lot, the Frontier handheld allows customer service attendants to select a zone, pre-authorize an amount on the client’s credit card, and print a voucher on a wireless printer attached to their waist — all within 10 seconds.

Utilizing the latest in GPRS wireless communications, the application was totally portable and could be price-configured for any zone, simply by logging in to the handheld and selecting a location to sell from. The handheld was simply an access device to the central database. “Our biggest concern was the connection and the speed of the application over the wireless radio,” stated McCracken. “We are very pleased by the data throughput we are seeing in the application.”

After the client completes the ride, the voucher is given to the cabbie, who writes the correct fare and any tip and has the rider sign the voucher. The voucher is taken to a redemption center where it is authenticated to the central database. The card is authorized for the actual amount, and the cabbie is given cash, less a processing fee.

Frontier plans on rolling out to 20 major metropolitan areas concentrating on airports and in some instances, major hotels. At full rollout, Frontier plans on 300-500 devices in the field conducting 18 million transactions annually.

Learn more about Livewire’s solutions for Automated Ticketing.